When it comes to investing in the stock market, understanding the impact of share price on a company like the Indian Renewable Energy Development Agency (IREDA) is crucial for making informed decisions. IREDA is a leading financial institution dedicated to promoting and financing renewable energy projects in India. As such, its share price performance can be influenced by a variety of factors that are unique to the renewable energy sector as well as broader market conditions. In this article, we will explore the significance of share price movements on IREDA, what investors need to know, and how they can navigate this information to make sound investment choices.

The Significance of Share Price

What is Share Price?

Share price refers to the current market value of a single share of a company’s stock. It is determined by the interactions of buyers and sellers in the market and can fluctuate based on various factors such as company performance, industry trends, economic conditions, and investor sentiment.

Share Price as an Indicator

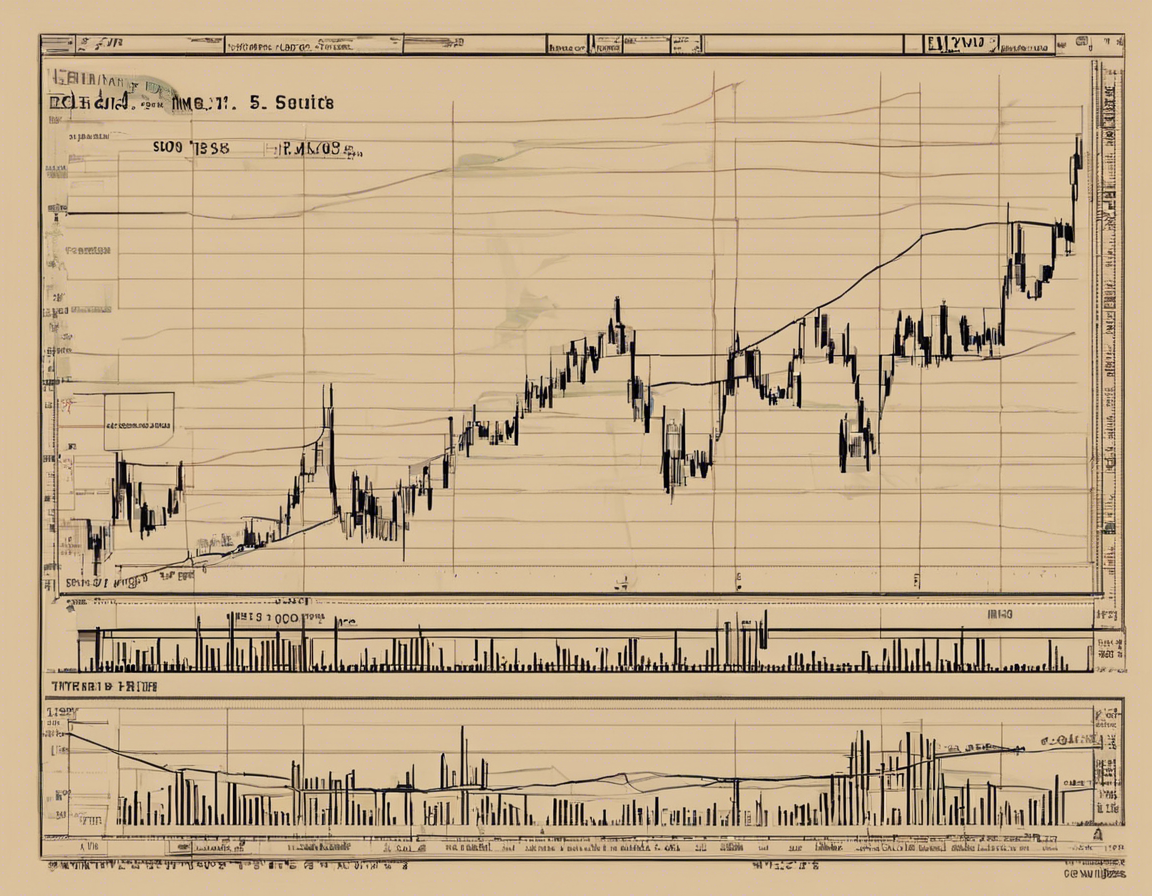

The share price of a company like IREDA can serve as an important indicator of its financial health and market perception. A rising share price may suggest investor confidence in the company’s growth prospects, profitability, and overall performance. On the other hand, a declining share price could signal concerns about the company’s operations, management, or external factors affecting its business.

Impact on Investors

For investors in IREDA, monitoring the company’s share price is essential for assessing the value and potential returns of their investments. Changes in share price can directly impact the overall portfolio performance, capital gains or losses, and investor sentiment towards the company.

Factors Influencing IREDA’s Share Price

Industry Trends

As a key player in the renewable energy sector, IREDA’s share price can be influenced by industry trends such as government policies, technological advancements, and global demand for clean energy solutions. Positive developments in the renewable energy sector, such as favorable regulations or increased investment in green energy projects, can drive up IREDA’s share price.

Financial Performance

IREDA’s financial performance, including revenue growth, profitability, and asset quality, can have a significant impact on its share price. Strong financial results, such as higher earnings or expanding loan portfolios, are likely to attract investors and support a higher share price.

Market Sentiment

Investor sentiment towards IREDA and the broader stock market can also affect its share price. Positive news coverage, analyst recommendations, or market rumors can create buying interest and drive up the share price. Conversely, negative sentiment or market volatility may lead to a decline in share price.

Macroeconomic Factors

Macroeconomic factors such as interest rates, inflation, and GDP growth can influence IREDA’s share price. Changes in economic conditions can impact the demand for renewable energy projects, borrowing costs, and overall investment sentiment, all of which can affect the company’s share price.

Strategies for Investors

Research and Analysis

Conducting thorough research and fundamental analysis of IREDA, including its financial statements, market position, and competitive advantages, can help investors make informed decisions about its share price performance.

Diversification

Diversifying investment portfolios across different asset classes, industries, and geographies can help reduce the impact of volatility in IREDA’s share price on overall portfolio returns.

Long-Term Perspective

Taking a long-term perspective when investing in IREDA can help investors ride out short-term fluctuations in share price and capture the potential benefits of the company’s growth and sustainable business model.

Risk Management

Implementing risk management strategies, such as setting stop-loss orders, using trailing stop orders, or hedging with derivatives, can help investors protect their investments from significant losses due to adverse movements in IREDA’s share price.

Frequently Asked Questions (FAQs)

1. What drives IREDA’s share price?

IREDA’s share price is driven by a combination of factors, including industry trends, financial performance, market sentiment, and macroeconomic conditions.

2. How can investors assess the value of IREDA’s share price?

Investors can assess the value of IREDA’s share price by conducting research, analyzing its financial statements, and comparing its valuation metrics with industry peers.

3. What are the risks associated with investing in IREDA?

Risks associated with investing in IREDA include regulatory changes, competition in the renewable energy sector, interest rate fluctuations, and macroeconomic uncertainties.

4. Is IREDA a good investment for sustainable investors?

IREDA is considered a socially responsible investment due to its focus on promoting renewable energy projects. Sustainable investors may find IREDA attractive for its positive environmental impact and long-term growth potential.

5. How can investors stay informed about IREDA’s share price movements?

Investors can stay informed about IREDA’s share price movements through financial news sources, stock market websites, company announcements, analyst reports, and investor relations channels.

In conclusion, understanding the impact of share price on IREDA is essential for investors looking to capitalize on opportunities in the renewable energy sector. By analyzing key factors influencing share price movements, implementing sound investment strategies, and staying informed about the company’s performance, investors can make well-informed decisions that align with their financial goals and risk tolerance.